Beginner’s Guide to Investing in Stocks Without Taking Big Risks

The stock market is often depicted in popular culture as a high-stakes casino where fortunes are made or lost on the whim of a single ticker symbol. This perception creates a significant barrier to entry for the average person, who understandably fears losing their hard-earned savings. However, investing in stocks does not have to be a gamble. When approached with a long-term perspective and a structured methodology, the stock market is one of the most effective vehicles for wealth creation ever devised. For a beginner, the goal is not to \\\\\\\\\\\\\\\"beat the market\\\\\\\\\\\\\\\" through risky speculation, but to participate in the steady growth of the global economy while minimizing exposure to unnecessary volatility.

Shifting the Perspective: Investing vs. Trading

To invest without taking big risks, one must first distinguish between investing and trading. Trading involves the frequent buying and selling of stocks based on short-term price movements. This is a high-risk activity that requires constant attention, advanced technical knowledge, and a high tolerance for loss. Statistics consistently show that the vast majority of day traders lose money over the long term.

Investing, by contrast, is the act of buying a piece of a business with the intention of holding it for years or even decades. When you buy a stock, you are becoming a partial owner of a company. If that company grows, innovates, and remains profitable, your share of that company becomes more valuable. By shifting your focus from the daily \\\\\\\\\\\\\\\"noise\\\\\\\\\\\\\\\" of price fluctuations to the long-term health of the underlying businesses, you naturally reduce the emotional stress and financial risk associated with market volatility.

The Power of Diversification: Not Putting All Eggs in One Basket

The single most effective way to reduce risk in the stock market is through diversification. If you invest all your money into a single company, you are vulnerable to \\\\\\\\\\\\\\\"idiosyncratic risk\\\\\\\\\\\\\\\"—the risk that a specific company will fail due to poor management, a technological shift, or a legal scandal. If that company goes bankrupt, your investment goes to zero.

Diversification solves this by spreading your money across hundreds or thousands of different companies across various sectors and geographies. If you own a small piece of 500 different companies, the failure of one or two will have a negligible impact on your overall portfolio. In today’s market, the easiest way for a beginner to achieve instant diversification is through Index Funds or Exchange-Traded Funds (ETFs). An index fund, such as one that tracks the S&P 500, allows you to own a slice of the 500 largest publicly traded companies in the United States with a single purchase.

Understanding the Risk-Reward Trade-off with Asset Allocation

Risk management is largely a function of asset allocation—the balance between stocks and safer assets like bonds or cash. Stocks are considered \\\\\\\\\\\\\\\"growth\\\\\\\\\\\\\\\" assets because they have high potential returns but come with higher volatility. Bonds are \\\\\\\\\\\\\\\"income\\\\\\\\\\\\\\\" assets; they generally provide lower returns but are much more stable and act as a cushion when the stock market is down.

A beginner looking to minimize risk should avoid a 100% stock portfolio. By including a percentage of high-quality government or corporate bonds, you can significantly dampen the \\\\\\\\\\\\\\\"swings\\\\\\\\\\\\\\\" of your portfolio. If the stock market drops by 20%, a portfolio that is 40% in bonds might only drop by 12%. This stability is crucial for beginners because it prevents the panic-selling that often occurs during market downturns. The right allocation depends on your age and when you will need the money; the longer your timeline, the more stocks you can comfortably afford to hold.

Dollar-Cost Averaging: Removing the Risk of Bad Timing

One of the biggest fears for new investors is \\\\\\\\\\\\\\\"buying at the top\\\\\\\\\\\\\\\"—investing a large sum of money right before a market crash. To eliminate this risk, professional investors use a strategy called Dollar-Cost Averaging (DCA).

Instead of investing a lump sum all at once, you invest a fixed amount of money at regular intervals, such as $200 every month, regardless of what the market is doing. When prices are high, your $200 buys fewer shares. When prices are low (and stocks are \\\\\\\\\\\\\\\"on sale\\\\\\\\\\\\\\\"), your $200 buys more shares. Over time, this results in a lower average cost per share and removes the psychological pressure of trying to \\\\\\\\\\\\\\\"time the market.\\\\\\\\\\\\\\\" DCA turns market volatility into an advantage, as it forces you to buy more when prices are depressed.

Focusing on Quality and Low-Cost Investments

Risk isn\\\\\\\\\\\\\\\'t just about market movement; it’s also about the erosion of your returns through high fees. Many traditional mutual funds carry \\\\\\\\\\\\\\\"expense ratios\\\\\\\\\\\\\\\" or management fees that can exceed 1% or 2% annually. While this sounds small, over thirty years, these fees can consume up to a third of your total wealth.

To invest safely and efficiently, beginners should prioritize low-cost, \\\\\\\\\\\\\\\"passive\\\\\\\\\\\\\\\" index funds. These funds simply track a market index rather than paying a human manager to try and pick \\\\\\\\\\\\\\\"winning\\\\\\\\\\\\\\\" stocks. Because they require less management, their fees are often as low as 0.03%. By keeping your costs low, you ensure that more of the market’s growth stays in your pocket, providing a larger margin of safety for your financial future.

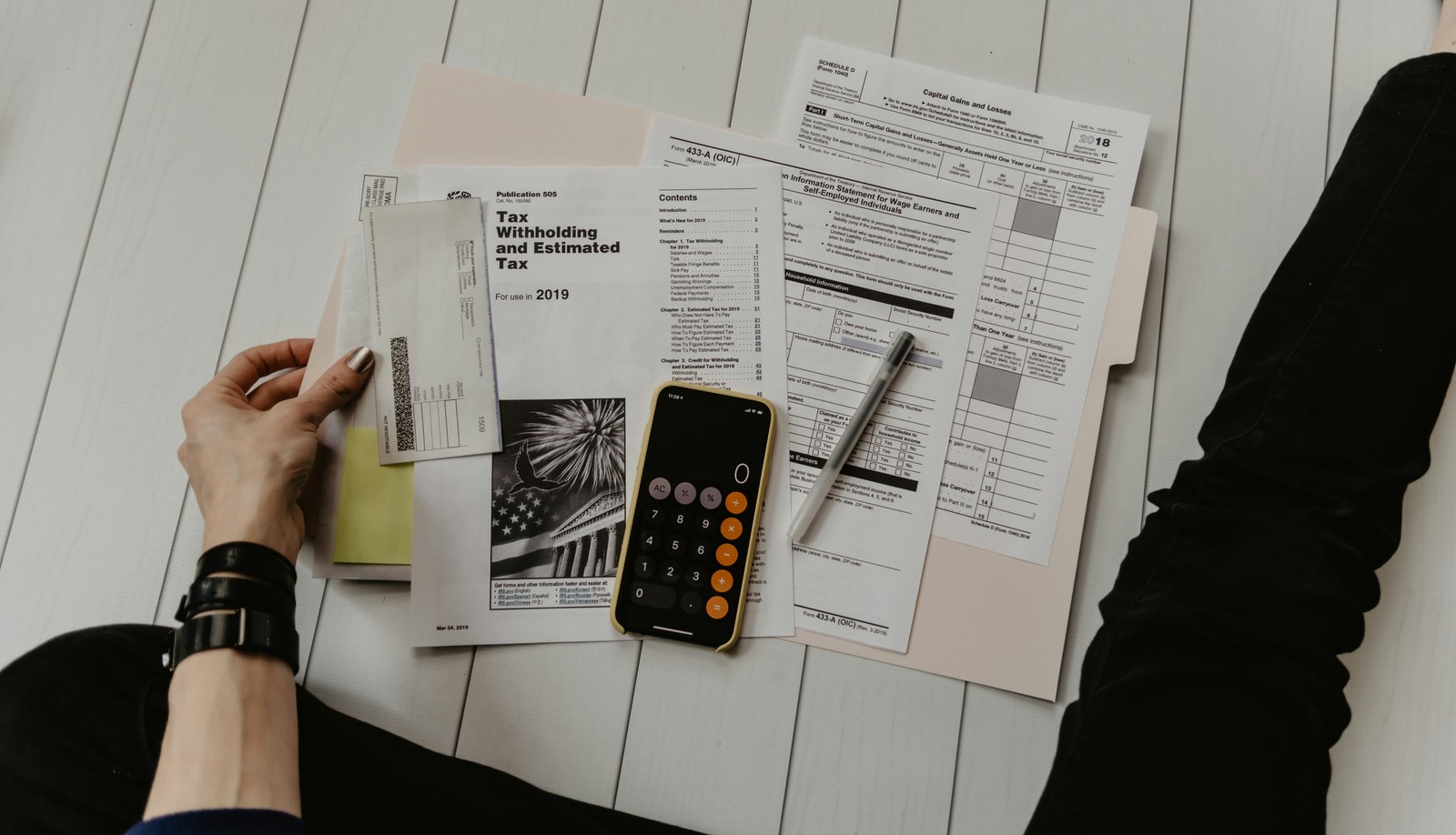

The Role of an Emergency Fund in Risk Management

It may seem counterintuitive, but the most important part of a low-risk stock market strategy happens outside the brokerage account. You should never invest money in the stock market that you might need in the next three to five years.

If you are forced to sell your stocks during a market downturn because you need to pay for a car repair or a medical bill, you are locking in a loss. Having a fully funded emergency fund in a high-yield savings account is what allows you to be a \\\\\\\\\\\\\\\"risk-tolerant\\\\\\\\\\\\\\\" investor. It provides the \\\\\\\\\\\\\\\"staying power\\\\\\\\\\\\\\\" required to leave your investments untouched during the inevitable rainy days of the economy, allowing them the time they need to recover and grow.

Developing a Long-Term Mindset

Finally, the greatest risk to a beginner investor is often their own behavior. The human brain is wired to react to perceived danger, and a red numbers on a screen can trigger a \\\\\\\\\\\\\\\"fight or flight\\\\\\\\\\\\\\\" response. Successful, low-risk investing requires the discipline to ignore the daily headlines and stick to your plan.

Understand that market corrections (a drop of 10% or more) happen almost every year, and bear markets (a drop of 20% or more) happen roughly every few years. These are not signs that the system is broken; they are a natural part of the economic cycle. By staying invested through these periods, you benefit from the long-term upward trajectory of human innovation and productivity.

Investing in stocks without taking big risks is not about finding a \\\\\\\\\\\\\\\"secret\\\\\\\\\\\\\\\" stock; it is about building a diversified, low-cost portfolio, investing consistently through dollar-cost averaging, and having the patience to let time and compound interest do the heavy lifting. By following these principles, you transform the stock market from a place of anxiety into a reliable engine for your long-term prosperity.

Comments 0 New!

You must be logged in to post comments and interact with others.

Login to CommentLoading comments...