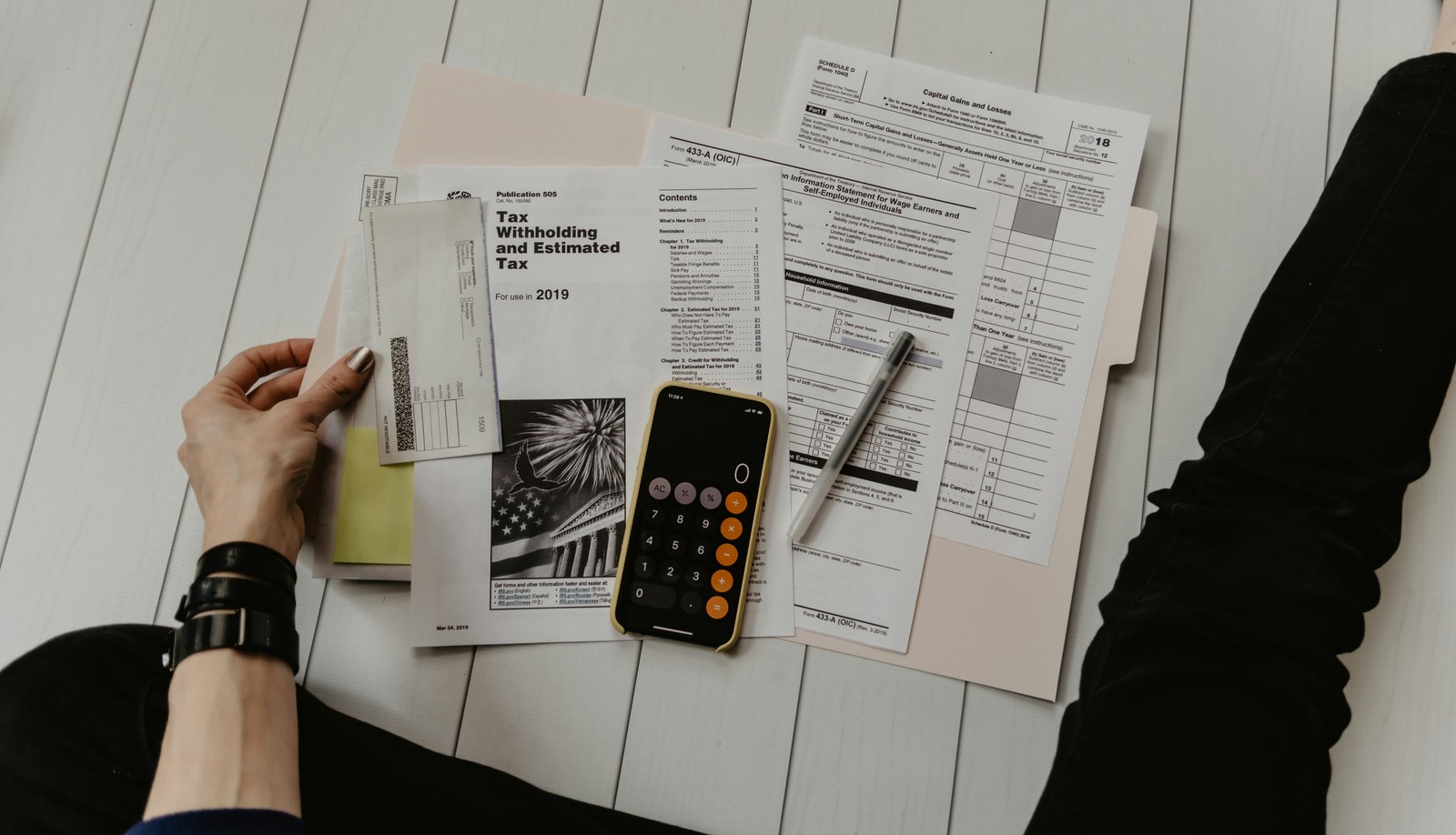

In the modern financial landscape, your credit score is more than just a three-digit number; it is a vital sign of your economic health. This numerical representation of your creditworthiness acts as a gatekeeper, determining whether you can secure a mortgage, lease an apartment, get a competitive rate on an auto loan, or even land certain jobs. For many, the credit score feels like a mysterious and arbitrary grade assigned by invisible institutions. However, the system is governed by specific logic and repeatable patterns. By understanding the mechanics of how these scores are calculated, you can move from a position of passive observation to active management, implementing strategies that can elevate your standing in a surprisingly short amount of time.

The Anatomy of a Credit Score

To improve your score, you must first understand what builds it. Most lenders use the FICO model, which aggregates data from your credit reports into five distinct categories, each weighted differently.

The most significant factor is payment history (35%). This tracks whether you pay your bills on time. Even a single payment that is thirty days late can cause a significant drop in your score, as it signals to lenders that you may be a risky borrower. The second most important factor is amounts owed (30%), also known as credit utilization. This looks at how much of your available credit you are actually using. If you have a credit card with a $10,000 limit and you are carrying a $9,000 balance, your high utilization ratio suggests you are overextended.

The remaining 35% is split between length of credit history (15%), credit mix (10%), and new credit (10%). Lenders want to see that you have managed different types of accounts over a long period. Frequent applications for new credit cards or loans can signal financial distress, leading to minor, temporary dips in your score known as \\\"hard inquiries.\\\"

Rapid Improvement Through Credit Utilization

If you are looking for the fastest possible way to boost your score, focusing on credit utilization is your most powerful lever. Unlike payment history, which can take years of consistency to \\\"heal\\\" after a late payment, utilization has no memory. The moment your balance drops and is reported to the credit bureaus, your score reflects that change.

Financial experts recommend keeping your utilization below 30%, but for those seeking an elite score, the \\\"sweet spot\\\" is actually below 10%. To lower this ratio quickly, you have two options: pay down the debt or increase your limit. If you have some extra cash, making a large payment toward your highest-balance card can result in a score increase in as little as 30 days. Alternatively, you can call your credit card issuer and request a credit limit increase. If they grant it and you do not increase your spending, your utilization ratio drops instantly. This is a highly effective \\\"hack,\\\" provided you have the discipline not to see the new limit as an invitation to spend more.

The Strategy of Micropayments

Another effective \\\"fast\\\" strategy involves the timing of your payments. Most credit card companies report your balance to the bureaus once a month on the \\\"statement closing date.\\\" If you pay your bill in full on the due date, you might still show a high utilization if the statement closed while you had a high balance.

To circumvent this, adopt the strategy of making multiple payments throughout the month—often called \\\"micropayments.\\\" By paying off your charges every week or just before the statement closing date, you ensure that the balance reported to the credit bureaus is as low as possible. This can result in an immediate score bump because it makes you appear to be using very little of your available credit, regardless of how much you actually spent and paid off during the month.

Scrubbing Errors and Disputing Inaccuracies

Your credit score is only as accurate as the data behind it, and credit reports are notoriously prone to errors. According to various consumer advocacy studies, nearly one in four credit reports contains a mistake serious enough to affect a score. These errors can range from accounts that don\\\'t belong to you to payments incorrectly marked as late.

Under the Fair Credit Reporting Act, you have the right to dispute any information on your credit report that is inaccurate or incomplete. You should pull your free reports from the three major bureaus—Equifax, Experian, and TransUnion—and scrutinize them for discrepancies. If you find an error, filing an online dispute can lead to its removal within 30 to 45 days. Removing a single erroneous late payment or an \\\"open\\\" account that was actually closed can cause your score to jump significantly in a very short window.

Leveraging the \\\"Authorized User\\\" Shortcut

For those with a thin credit file or a low score, one of the most effective ways to inherit a better history is through \\\"credit piggybacking.\\\" This involves being added as an authorized user on the credit card account of a trusted family member or friend who has a long history of perfect payments and low utilization.

When you are added as an authorized user, that card’s entire history—often spanning years—is added to your credit report. If the account is ten years old and has never had a late payment, your \\\"length of credit history\\\" and \\\"payment history\\\" metrics will improve overnight. The best part is that you don\\\'t even need to use the physical card; simply being linked to the account is enough to reap the benefits. However, this is a double-edged sword: if the primary account holder misses a payment or maxes out the card, your score will suffer as well.

Dealing with Collections and Delinquencies

If your score is being held down by old collection accounts, you may be able to use a \\\"pay for delete\\\" strategy. While not always successful, some collection agencies are willing to remove the negative entry from your credit report entirely if you pay the debt in full. It is vital to get this agreement in writing before sending any money. While newer credit scoring models are starting to ignore paid collections, many lenders still use older models where a \\\"paid\\\" collection is still a negative mark. Deleting the entry altogether is the only way to achieve a rapid, significant recovery from a prior default.

Consistency as the Ultimate Engine

While the strategies mentioned above can provide quick results, the long-term health of your credit score depends on automation and discipline. Set all your minimum payments to \\\"autopay\\\" to ensure you never miss a due date. Avoid the temptation to close old credit card accounts, even if you don\\\'t use them, as doing so shortens your average credit age and reduces your total available credit.

Building a great credit score is a combination of strategic \\\"sprints\\\" and a lifelong \\\"marathon.\\\" By understanding the levers of utilization, the importance of accuracy, and the power of existing credit relationships, you can transform your financial reputation. A higher credit score translates into thousands of dollars saved in interest over your lifetime, providing you with the ultimate leverage to build wealth and achieve your most ambitious financial goals.

Comments 0 New!

You must be logged in to post comments and interact with others.

Login to CommentLoading comments...