The difference between financial stability and chronic struggle is rarely determined by a single catastrophic event. Instead, it is usually the result of a series of subtle, recurring habits and structural errors that erode wealth over time. Many people find themselves trapped in a cycle of living paycheck to paycheck, not because they lack income, but because they have fallen into common financial traps that favor immediate gratification over long-term security. Understanding these pitfalls is the first step toward breaking the cycle and building a sustainable financial future.

The Trap of Lifestyle Inflation

Perhaps the most insidious mistake is lifestyle inflation—the tendency to increase spending every time income rises. When a professional receives a raise or a bonus, the instinct is often to \\\"upgrade\\\" their life: a more expensive car, a larger apartment, or more frequent luxury dining. While these upgrades feel like well-deserved rewards, they effectively neutralize the benefit of the higher salary.

If your expenses grow at the same rate as your income, your net worth remains stagnant. This keeps you on a \\\"hedonic treadmill,\\\" where you are working harder and earning more but never actually getting ahead. To build wealth, one must maintain a \\\"wealth gap\\\"—the difference between what you earn and what you spend. By keeping your living expenses relatively stable while your income grows, you create a surplus that can be funneled into assets that generate even more income.

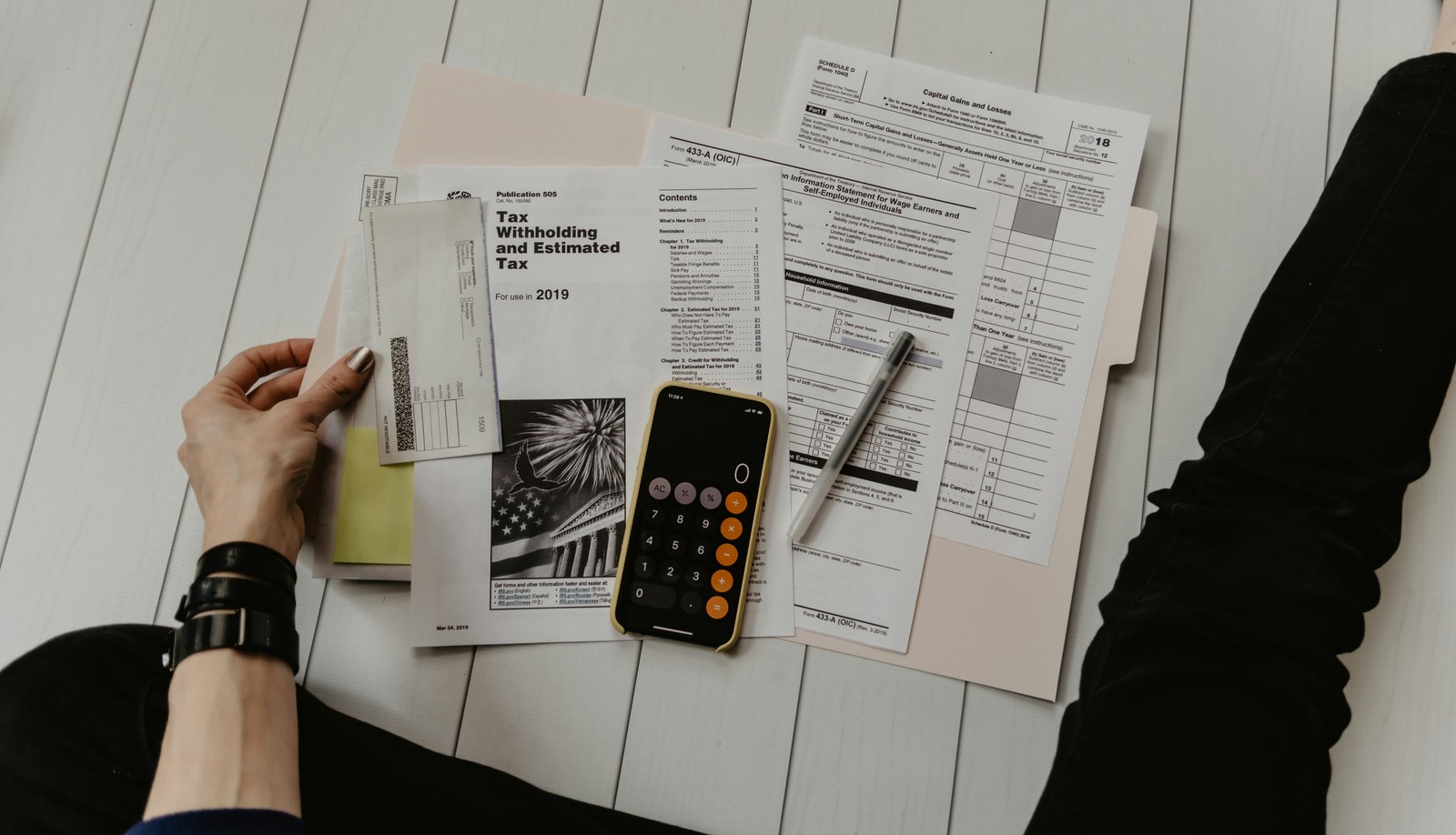

Relying on High-Interest Consumer Debt

In a consumer-driven society, debt has been rebranded as a tool for convenience. However, using high-interest credit cards to fund a lifestyle you cannot afford is a guaranteed way to stay poor. Consumer debt is a claim on your future labor; every dollar you spend on interest today is a dollar you cannot save or invest tomorrow.

The mistake many make is viewing credit card limits as extensions of their income. They pay only the minimum balance, unaware that at an 18% or 24% interest rate, they may end up paying double or triple the original price of the item over several years. This creates a \\\"debt trap\\\" where a significant portion of a person\\\'s monthly income is dedicated solely to servicing interest, leaving nothing for wealth-building. Breaking this cycle requires a radical shift in perspective: if you cannot pay for a non-essential item in cash, you cannot afford it.

The Absence of an Emergency Fund

Many people live on a financial tightrope, assuming that their current income will always be there and that no major expenses will arise. When the inevitable happens—a job loss, a medical emergency, or a major home repair—the lack of a cash cushion forces them to turn to high-interest debt.

This creates a \\\"poverty spiral.\\\" You take out a loan or use a credit card to cover an emergency, and then your monthly expenses increase because of the new debt payment. This leaves you even more vulnerable to the next emergency. An emergency fund is not just a savings account; it is financial insurance. Without it, you are constantly one bad break away from a disaster that could take years to recover from.

Focusing on Saving Instead of Investing

While saving money is a vital first step, relying solely on a traditional savings account to build wealth is a fundamental mistake in an inflationary environment. Inflation acts as a hidden tax, eroding the purchasing power of your cash every year. If your money is sitting in an account earning 0.1% interest while inflation is at 3% or higher, you are effectively losing money every single day.

Poor financial planning often involves a fear of the stock market or other investment vehicles. People see volatility as a reason to stay away, but the real risk is the \\\"guaranteed loss\\\" of purchasing power over time. Wealthy individuals understand that money is a tool that must be put to work. By failing to invest in assets like low-cost index funds, real estate, or retirement accounts, individuals miss out on the power of compound interest—the single greatest force in wealth creation.

The \\\"Small Expense\\\" Blind Spot

A common refrain among those struggling financially is, \\\"I don\\\'t know where my money goes.\\\" This is usually because they are focused on large expenses like rent while ignoring the \\\"death by a thousand cuts\\\" caused by small, daily leaks.

Digital subscriptions you no longer use, daily premium coffee runs, frequent convenience store purchases, and delivery fees on food apps can easily total $500 to $1,000 a month for the average household. Because these transactions are small, they don\\\'t trigger the psychological \\\"pain of paying\\\" that a large purchase does. However, over a year, these habits can represent the difference between a funded retirement account and a zero balance. Tracking every cent for a month is often a transformative experience because it makes these invisible drains visible.

Prioritizing Appearance Over Assets

Social pressure plays a massive role in keeping people poor. The desire to \\\"keep up with the Joneses\\\" leads many to spend money they don\\\'t have on things they don\\\'t need to impress people they don\\\'t like. This results in \\\"pseudo-wealth\\\"—having the outward appearance of success (designer clothes, new cars) while having a negative or zero net worth.

True wealth is what you don\\\'t see; it is the money in brokerage accounts, the equity in real estate, and the ownership in businesses. When you prioritize buying depreciating assets (like cars and electronics) over appreciating assets (like stocks or education), you are trading your future freedom for a temporary social signal. Choosing a used car and a modest home while investing the difference is a hallmark of those who eventually become \\\"the millionaire next door.\\\"

Neglecting Financial Literacy and Personal Education

Finally, the most expensive mistake anyone can make is the assumption that financial management is \\\"too complicated\\\" to learn. Ignorance is the most expensive commodity in the world. People who do not understand how interest works, how taxes affect their income, or how to read a basic contract end up paying \\\"ignorance taxes\\\" in the form of high fees, predatory loans, and missed opportunities.

Financial literacy is a skill that can be developed. Many stay poor simply because they never took the time to read a book on personal finance or learn the basics of the tax code. In the information age, the resources to learn are largely free or low-cost. Refusing to invest time in your own financial education is a choice to remain at the mercy of institutions that profit from your lack of knowledge.

Breaking free from these mistakes requires more than just a higher salary; it requires a change in philosophy. It means moving from a life of reaction to a life of intention. By identifying these common traps and consciously choosing a different path, you can stop the drainage of your resources and begin the steady, rewarding process of building a life of true financial independence.

Comments 0 New!

You must be logged in to post comments and interact with others.

Login to CommentLoading comments...