The allure of passive income has grown exponentially in recent years, fueled by a desire for financial autonomy and a departure from the traditional \\\"trading time for money\\\" model. Passive income is often misunderstood as \\\"free money\\\" or a \\\"get rich quick\\\" scheme; in reality, it is the result of front-loading effort, capital, or creativity to create a system that generates revenue with minimal ongoing maintenance. In today’s rapidly evolving economy, characterized by digital transformation and shifting consumer behaviors, the most effective passive income streams are those that leverage existing platforms, solve specific problems, or utilize underappreciated assets. To build a sustainable stream of passive revenue, one must distinguish between fleeting trends and robust, proven strategies.

The Digital Product Revolution

One of the most accessible and scalable ways to generate passive income in the modern era is through the creation of digital products. Unlike physical goods, digital products—such as e-books, online courses, templates, and stock photography—have no inventory costs and negligible distribution expenses. Once the product is created, it can be sold an infinite number of times to a global audience.

The key to success in this space is the \\\"evergreen\\\" factor. By creating a course on a fundamental skill, such as project management or graphic design, or writing an instructional guide on a niche hobby, you create an asset that remains relevant for years. Platforms like specialized marketplaces for creators allow you to list these products where the infrastructure for payment processing and delivery is already in place. While the initial creation of a high-quality 10-module course may take hundreds of hours, the subsequent revenue is almost entirely passive, requiring only occasional updates to stay current with industry changes.

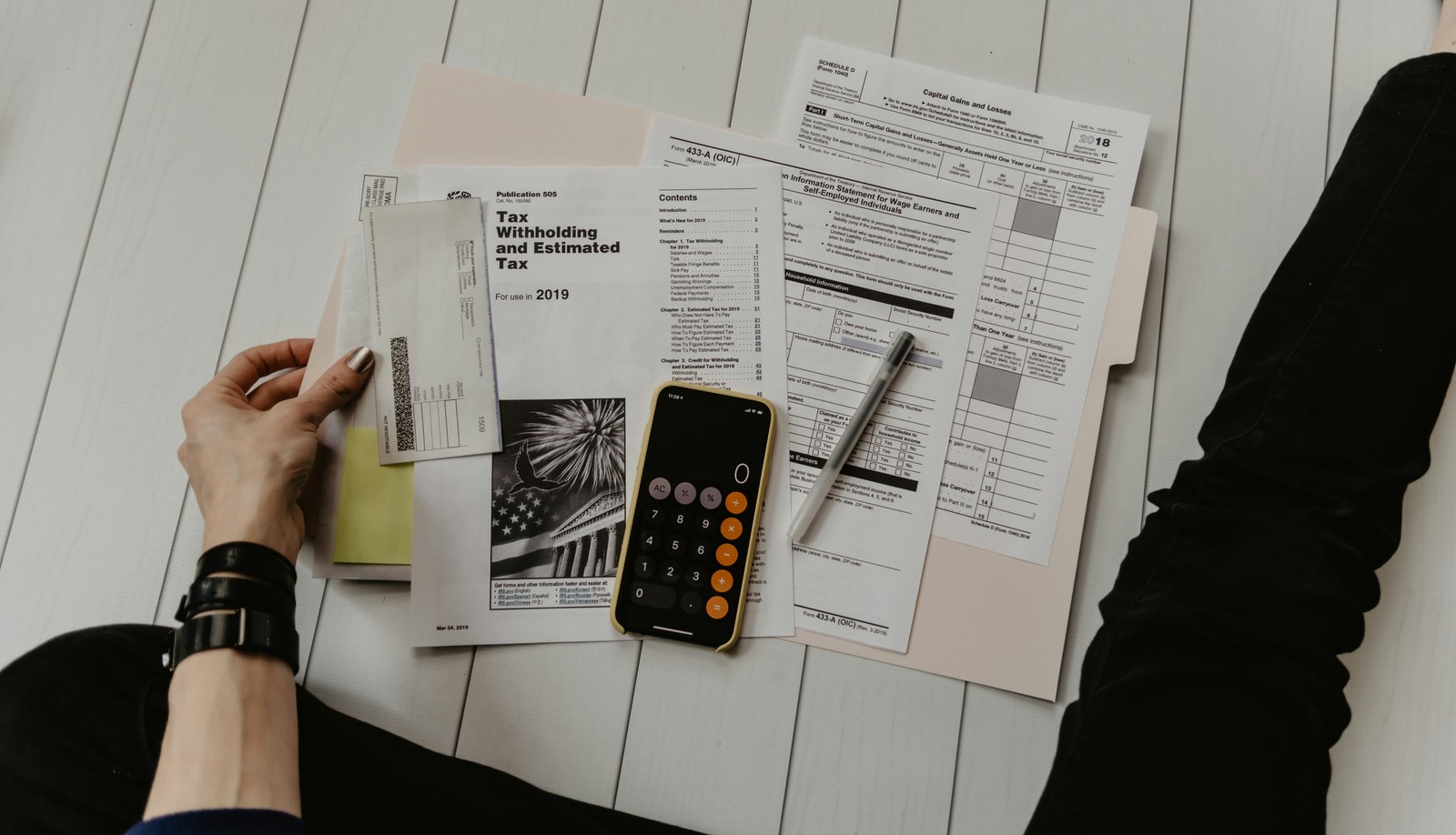

Dividend Growth Investing

For those with available capital, dividend growth investing remains one of the most reliable forms of passive income. This strategy involves purchasing shares of established companies that have a consistent history of paying out a portion of their profits to shareholders. Unlike growth stocks, which rely solely on the share price increasing, dividend stocks provide a regular \\\"check\\\" in the mail or a deposit into your brokerage account, typically every quarter.

The real power of this strategy lies in \\\"Dividend Aristocrats\\\"—companies that have not only paid but increased their dividends for at least 25 consecutive years. By reinvesting these dividends during your wealth-building phase, you harness the power of compounding. In today’s economy, where market volatility is common, a portfolio of high-quality dividend-paying stocks provides a psychological and financial cushion. As the company grows its earnings, your passive income grows alongside it, often outpacing inflation without requiring you to sell a single share of the underlying asset.

Real Estate and the Rise of Syndication

Real estate has long been the cornerstone of passive income, but the \\\"landlord\\\" model is often anything but passive. Managing tenants, repairs, and vacancies can be a full-time job. To make real estate truly passive in today’s economy, many investors are turning to Real Estate Investment Trusts (REITs) or real estate syndications.

REITs are companies that own, operate, or finance income-producing real estate across various sectors, from apartment complexes to data centers. By buying shares of a REIT, you receive a portion of the rental income generated by the properties without ever having to pick up a hammer or deal with a late rent check. For those with higher net worth, syndications allow you to pool your money with other investors to purchase large-scale commercial properties managed by professionals. These methods allow you to benefit from the tax advantages and cash flow of real estate while remaining entirely hands-off.

Content Creation and Ad Revenue

The \\\"creator economy\\\" has democratized access to advertising revenue, which was once the exclusive domain of major media corporations. By building a blog, a YouTube channel, or a niche podcast, individuals can create a content library that generates income through ads and sponsorships long after the content is published.

This model relies on the \\\"long tail\\\" of search traffic. An article or video that solves a specific problem—such as \\\"how to fix a leaky faucet\\\" or \\\"the best ways to save for a house\\\"—can continue to attract viewers through search engines for years. As long as the content remains relevant and the platform exists, the creator earns a share of the advertising revenue generated by those views. While building an audience requires significant initial \\\"sweat equity,\\\" a mature content library acts as a digital real estate portfolio that pays monthly dividends in the form of ad shares.

High-Yield Cash Cash Management

While not as glamorous as real estate or digital empires, the current interest rate environment has made high-yield cash management a viable passive income strategy for the first time in over a decade. High-yield savings accounts, Certificates of Deposit (CDs), and money market funds are currently offering rates that provide a meaningful return on idle cash.

For an individual with a large emergency fund or a short-term savings goal, move the money from a traditional \\\"big bank\\\" (which may pay 0.01% interest) to a high-yield online bank can result in hundreds or thousands of dollars in passive income annually. This is the most \\\"passive\\\" form of income available, as it requires only a few minutes to set up an account and link it to your primary bank. While it may not make you wealthy on its own, it ensures that your liquid capital is at least working to maintain its purchasing power.

Automated E-Commerce and Print-on-Demand

Modern logistics have made it possible to run an e-commerce business without ever touching a product. Print-on-demand (POD) is a specific model where you design artwork for apparel, mugs, or home decor and list them on a digital storefront. The product is only manufactured and shipped by a third-party partner when a customer makes a purchase.

This eliminates the biggest risks of traditional retail: inventory overhead and shipping logistics. Your role is purely creative and analytical—designing the products and optimizing the listings for search. Because the fulfillment process is entirely handled by the partner, the income generated from sales is passive. In today’s economy, where consumers increasingly seek unique, niche designs over mass-market products, a well-curated POD store can provide a steady stream of supplemental income with minimal weekly maintenance.

The Reality of Maintenance and Diversification

No passive income stream is truly \\\"set it and forget it\\\" forever. Every system requires occasional oversight to ensure it remains profitable. A digital course might need an update, a dividend stock might experience a payout cut, or a blog might need a fresh piece of content to maintain its search ranking.

The most successful practitioners of passive income avoid \\\"single-point-of-failure\\\" risk by diversifying their streams. They might combine the stability of dividend stocks with the high-growth potential of digital products and the inflation-hedging properties of real estate. By building multiple, independent sources of revenue, you create a financial fortress that provides security regardless of fluctuations in the broader economy. Passive income is not about avoiding work; it is about working intelligently today so that your future self has the luxury of choice.

Comments 0 New!

You must be logged in to post comments and interact with others.

Login to CommentLoading comments...