Building long-term wealth is rarely the result of a single brilliant investment or a stroke of luck. Instead, it is a disciplined process of managing resources, mitigating risks, and allowing time to amplify the results of consistent habits. Financial security is not merely about the balance in a bank account; it is the peace of mind that comes from knowing you have a structured plan to handle life’s uncertainties while steadily moving toward your ultimate objectives. To transition from basic survival to true wealth, you must implement a comprehensive financial plan that addresses the various stages of capital accumulation and protection.

The Foundation: Risk Management and Liquidity

Before focusing on growth, a professional financial plan must focus on defense. The most common reason long-term wealth strategies fail is not poor market performance, but rather the lack of a safety net that forces the liquidation of assets during a crisis.

The first pillar of security is the emergency fund. While standard advice suggests three to six months of expenses, those seeking high-level security often aim for twelve months. This liquidity ensures that job loss, medical emergencies, or economic downturns do not interrupt your long-term compounding.

The second pillar is insurance. Wealth can be wiped out in an instant by a liability claim, a health crisis, or the loss of a primary breadwinner. A robust plan includes term life insurance to protect dependents, disability insurance to protect your ability to earn, and adequate liability coverage on home and auto policies. By transferring these \\\\\\\"catastrophic risks\\\\\\\" to an insurance company, you ensure that your investment portfolio remains untouched, allowing it to grow uninterrupted over decades.

Asset Allocation and the Efficiency of Diversification

Once the foundation is secure, the focus shifts to asset allocation—the process of dividing your investments among different asset classes like stocks, bonds, real estate, and cash. This is the single most important driver of your long-term returns and risk profile.

A secure plan utilizes global diversification. Instead of betting on a single country or sector, you spread your capital across the entire world economy. This protects you against the decline of a specific industry or a localized recession. For most long-term investors, the core of this strategy involves low-cost index funds or Exchange-Traded Funds (ETFs) that track broad market indices.

The key to long-term success is maintaining your target allocation through rebalancing. Over time, some assets will grow faster than others, causing your portfolio to become skewed toward higher-risk categories. By periodically selling a portion of your winners and buying more of your underperforming assets, you inherently follow the classic investment wisdom of \\\\\\\"buying low and selling high\\\\\\\" without having to predict market movements.

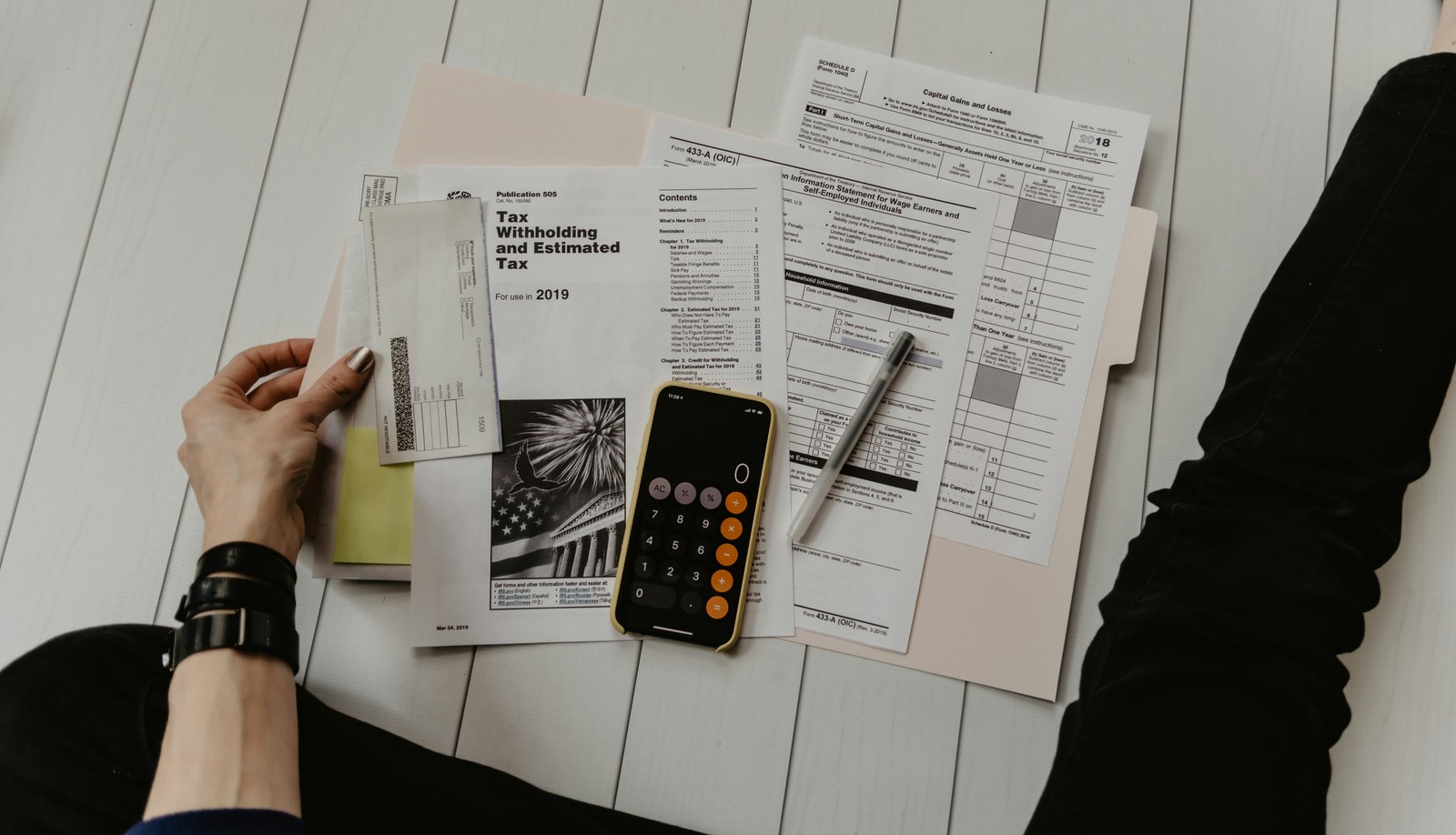

Tax-Efficient Investing Strategies

In the pursuit of wealth, it is not just about what you earn, but what you keep. Taxes are often the largest single expense an investor faces over their lifetime. A sophisticated financial plan utilizes tax-advantaged accounts to maximize growth.

This includes contributing to employer-sponsored plans like a 401(k) or 403(b), particularly when there is a company match, which represents a guaranteed return on investment. Additionally, Individual Retirement Accounts (IRAs)—both Traditional and Roth—offer unique tax benefits. A Roth IRA, for example, allows your investments to grow tax-free and provides for tax-free withdrawals in retirement. By strategically placing \\\\\\\"tax-heavy\\\\\\\" assets (like bonds or high-turnover funds) in tax-deferred accounts and \\\\\\\"tax-light\\\\\\\" assets (like broad-market stock funds) in taxable accounts, you can significantly increase your net terminal wealth without taking on any additional market risk.

The Role of Real Estate in Wealth Preservation

While the stock market provides liquidity and growth, real estate offers a different type of security: tangible value and inflation protection. Long-term wealth management often includes real estate as a \\\\\\\"hard asset\\\\\\\" that can provide a steady stream of rental income.

Unlike stocks, real estate is a finite resource. As inflation rises and the cost of labor and materials increases, the value of existing property typically follows. Furthermore, real estate allows for the use of leverage (a mortgage) to amplify returns. For a secure financial plan, real estate acts as a stabilizer. If the stock market is volatile, the rental income from a property remains relatively stable, providing a diverse source of cash flow that is not directly correlated to the fluctuations of the public markets.

Managing Lifestyle Creep and the Savings Rate

The most mathematically significant variable in any financial plan is your savings rate—the percentage of your income that you actually keep and invest. Many high-earning professionals remain financially fragile because they fall victim to lifestyle creep. As their income increases, so does their spending on luxury cars, larger homes, and expensive social circles.

To build long-term security, you must consciously decouple your standard of living from your income. A common strategy is to \\\\\\\"invest half of every raise.\\\\\\\" By allowing your lifestyle to improve slightly while simultaneously increasing your contributions to your wealth-building engine, you satisfy the human desire for progress without sabotaging your future. True wealth is built in the gap between what you earn and what you spend; the wider you can keep that gap, the faster you achieve the \\\\\\\"critical mass\\\\\\\" where your investments generate enough income to cover your life.

Estate Planning: Preserving Wealth Across Generations

A complete financial plan does not end with your retirement; it addresses the eventual transfer of your assets. Estate planning is the process of ensuring your wealth goes to your intended beneficiaries with minimal tax consequences and legal delays.

This involves more than just a simple will. It includes setting up trusts to protect assets from creditors or irresponsible spending, designating powers of attorney for financial and medical decisions, and ensuring that beneficiary designations on retirement accounts and life insurance policies are up to date. Without these protections, your wealth can be significantly eroded by probate fees and estate taxes, leaving your heirs with a fraction of what you intended. Proper estate planning is the final step in ensuring that the security you worked a lifetime to build survives for the next generation.

Consistency and the Long-Term Mindset

The ultimate tip for financial planning is the acknowledgment that success is a marathon, not a sprint. The market will experience crashes, tax laws will change, and personal circumstances will fluctuate. The individuals who achieve true security are those who do not panic during volatility or get greedy during bull markets.

By automating your investments, maintaining a diversified portfolio, and keeping your expenses in check, you remove the need for constant, stressful decision-making. Wealth building is often boring and repetitive, but it is precisely that consistency that yields extraordinary results. Financial planning is the act of being kind to your future self, ensuring that the person you become decades from now has the resources to live a life of dignity, choice, and absolute security.

Comments 0 New!

You must be logged in to post comments and interact with others.

Login to CommentLoading comments...