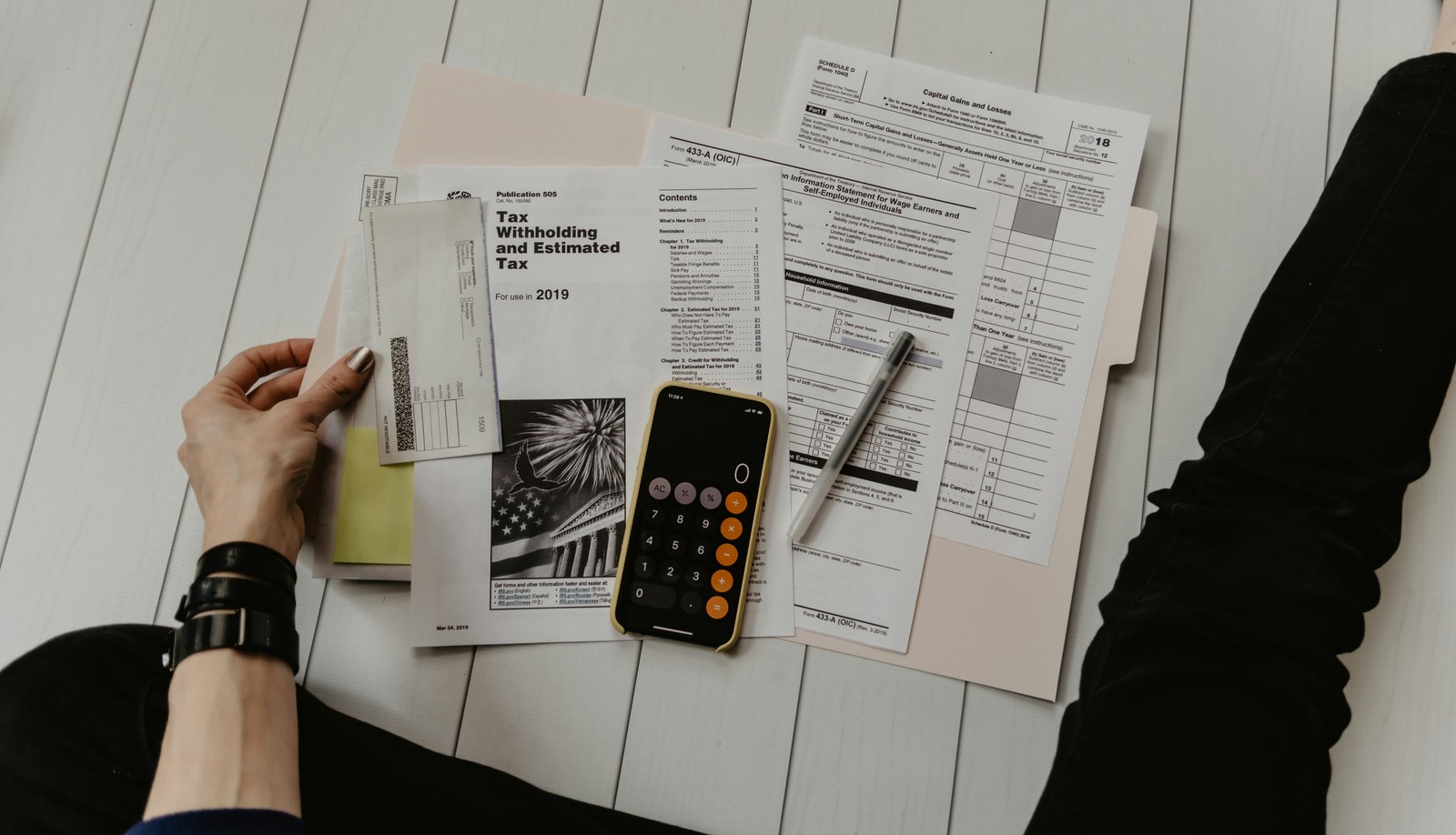

The journey toward financial independence often feels overwhelming because of the sheer scale of the ultimate objective. Many individuals view wealth as a destination reached through luck or an extraordinary windfall, but in reality, financial success is the byproduct of a structured goal-setting process. Without a clear set of defined targets, money tends to dissipate into the friction of daily living. To build long-term wealth, you must learn how to categorize your ambitions into a timeline that balances your immediate needs with your future security. By mastering the art of the financial \\\\\\\"sprint\\\\\\\" and the \\\\\\\"marathon,\\\\\\\" you transform your income from a means of survival into a tool for intentional life design.

The SMART Framework for Financial Targets

A vague desire to \\\\\\\"have more money\\\\\\\" is not a goal; it is a wish. To be effective, a financial goal must be actionable. Most successful planners use the SMART criteria to define their objectives. This means a goal must be Specific, Measurable, Achievable, Relevant, and Time-bound.

Instead of saying, \\\\\\\"I want to save for a house,\\\\\\\" a SMART goal would be, \\\\\\\"I will save $50,000 for a down payment in four years by automating a $1,000 monthly transfer to a dedicated high-yield savings account.\\\\\\\" This level of detail provides a roadmap and an immediate way to track progress. It removes the guesswork and allows you to see exactly where you stand at any given moment. When you hit a milestone, the psychological reinforcement provides the fuel needed to move on to the next, more difficult target.

Short-Term Goals: Building the Foundation

Short-term goals are objectives you aim to achieve within one year. These are the \\\\\\\"quick wins\\\\\\\" that provide the stability necessary for riskier or more long-term ventures. The primary focus of short-term goals is usually liquidity and protection.

The first essential short-term goal is the creation of a starter emergency fund. This acts as a financial shock absorber, ensuring that a minor car repair or a broken appliance doesn\\\\\\\'t force you back into high-interest debt. Following this, short-term goals might include paying off a small credit card balance, saving for a modest vacation, or building a \\\\\\\"sinking fund\\\\\\\" for annual expenses like car insurance or holiday gifts. By successfully managing these one-year targets, you develop the financial \\\\\\\"muscle memory\\\\\\\" required for more complex planning.

Medium-Term Goals: The Bridge to Your Future

Medium-term goals generally span a timeline of one to five years. These objectives often represent significant life transitions or the acquisition of major assets. Because the timeline is longer than a year, you cannot rely solely on your monthly cash flow; you must implement consistent, disciplined saving and perhaps conservative investing.

Common medium-term goals include saving for a down payment on a home, funding a wedding, or saving for a graduate degree. During this phase, the choice of where to store your money becomes critical. Since you will need the funds in a relatively short window, the priority remains capital preservation. High-yield savings accounts or short-term Certificates of Deposit (CDs) are often the preferred vehicles, as they offer slightly better returns than a standard savings account without the volatility of the stock market.

Long-Term Goals: The Vision of Wealth

Long-term goals are those that are five, ten, or even forty years away. The most prominent of these is retirement, but it could also include paying off a thirty-year mortgage or fully funding a child’s college education. This is where the strategy shifts from \\\\\\\"saving\\\\\\\" to \\\\\\\"investing.\\\\\\\"

Because of the extended timeline, you have the advantage of market cycles and compound interest. In the long term, the greatest risk is not market volatility, but inflation—the steady erosion of your money’s purchasing power. To combat this, long-term goals must be funded through growth-oriented assets like stocks and real estate. While these assets may fluctuate in the short term, they have historically provided the returns necessary to turn modest monthly contributions into the massive sums required for decades of post-work life.

The Power of Prioritization and Sequencing

A common mistake in financial planning is trying to achieve every goal simultaneously. If you try to save for a house, pay off student loans, and invest for retirement all with the same limited pool of money, you may find that you make negligible progress on all three.

Wisely managing your money requires sequencing. This involves identifying which goals provide the most \\\\\\\"leverage.\\\\\\\" For example, if your employer offers a retirement match, that is a 100% return on your investment, making it a higher priority than almost any other goal. Similarly, paying off a 20% interest credit card is a higher priority than saving for a house down payment because the interest you are losing is likely much higher than the appreciation you would gain on a home. By focusing your intensity on one or two high-priority goals at a time, you reach your milestones faster and create a \\\\\\\"snowball effect\\\\\\\" for your subsequent objectives.

Reviewing and Adjusting Your Roadmap

Financial goal setting is not a \\\\\\\"set it and forget it\\\\\\\" activity. Life is dynamic; your priorities at twenty-five will be vastly different from your priorities at forty-five. An effective financial plan requires at least an annual review.

During this review, you should assess your progress, adjust for changes in income, and account for inflation. If you receive a raise, you have a choice: you can increase your current lifestyle (lifestyle inflation) or you can shorten the timeline for your goals. If you find that a medium-term goal—like buying a house—is no longer a priority, you can redirect those funds toward your long-term wealth-building engine. This flexibility ensures that your money is always working toward the life you actually want to live today, rather than a plan you made years ago.

The Psychological Reward of Intentionality

Ultimately, the purpose of setting financial goals is to remove the anxiety associated with money. When you have a plan, a market downturn or an unexpected expense is no longer a catastrophe; it is a variable you have already accounted for in your strategy.

There is a profound sense of empowerment that comes from seeing a long-term goal move from a distant possibility to a mathematical certainty. By breaking down your financial life into short-term wins and long-term marathons, you stop being a passive participant in your economic life. You become the architect of your own freedom, ensuring that every dollar you earn is a brick in the foundation of a secure, wealthy, and meaningful future.

Comments 0 New!

You must be logged in to post comments and interact with others.

Login to CommentLoading comments...